Wednesday, August 29

You guys suck

I posted my brilliant Tax diatribe here almost a month ago and received 1 comment.

I posted the same article on Daily Kos and received...53 comments within 24 hours. You guys suck.

As such, I'm retiring this blog. Anything new I post on DailyKos will appear on this blog, but I will no longer continue posting for it. (That means no more Monthly Machiavellis or Forwarded Articles--unless it's one I really like.) You should all be ashamed of yourself.

Sunday, August 26

Monthly Machiavelli: August

...and the award for 'Outstanding Political Acumen' goes to:

Hillary Clinton!

Why she won: There are several reasons why Hillary deserves the award this month.

Why she won: There are several reasons why Hillary deserves the award this month.For one, a little over a month ago, I declared that I would never vote for Mrs. Clinton no matter what party nominated her. Since that time, her poise in debates, a recalculation on my part on her possibilities of winning, sound political maneuvers, and some self-destructions by rival candidates have moved me from considering voting for her and even leaning towards a vote for her.

In debates, and there have been many of them, Hillary has shined as a politician with skills above the rest. I was surprised by this considering that she had never engaged in a competitive debate previously. She is now the obvious front runner among both parties and is accumulating a small fortune in campaign donations...

The next president?

Tuesday, August 21

Welfare in America

A couple paragraphs from another one of my heroes, author of the weekly ESPN magazine articles entitled "Tuesday Morning Quarterback", Gregg Easterbrook:

<< Wealthy ex-presidents reach into your pockets: Recently, the Congressional Research Service announced the federal subsidies requested for the coming fiscal year by ex-presidents Jimmy Carter, George Herbert Walker Bush and Bill Clinton. Globe-trotting Carter asked for only $2,000 for travel; Bush and Clinton, both millionaires, wanted $50,000 from taxpayers for travel. Bush said he needed $69,000 for "equipment" and $13,000 for postage. Is Bush planning to mail 32,000 thank-you notes next year?

AP Photo

Hi, we're rich, give us your money.

>>

Monday, August 20

Another forwarded post...

This one comes from Robert Reich's Blog. Reich was my professor for one day and he is one of few economists who actually knows what he's talking about. You may notice that he was inspired by my other blog, but I can't really blame him for copying me, considering my immense popularity. Without

further delay--Bailing Out the Speculators:

further delay--Bailing Out the Speculators:<<

Bailing Out the Speculators

Last night the Federal Reserve Board, acting as America’s central bank, sliced half a percentage point off the discount rate it charges banks for loans. The move was designed to give banks, in turn, more money to lend to their customers. But its primary purpose was to lift the confidence of investors and consumers in the United States and around the world that America’s central bank would do whatever necessary to keep the American economy going.Ordinarily, central banks shouldn’t bail out speculators. It’s not their job to protect investors from themselves. In particular, it’s bad policy to make money cheaper – and investments thereby less risky – after investors have been hoisted on the petards of their own foolishness. That only invites more foolishness next time around.

Yet there’s precedent: In August of 1998, despite growing evidence of inflation, the Federal Reserve Board lowered interest rates in order to forestall a global credit crisis after Russia defaulted on its loans (many of which had been underwritten, foolishly, by several large Wall Street investment banks that assumed Russia would never default). Weeks later the Fed pressured banks to reschedule the debts of a giant hedge fund called Long-Term Capital Management, for fear that if the hedge fund went belly up, it would cause a crisis in credit markets.

In other words, ordinary rules don’t apply in extraordinary circumstances. That several thousand lower-income Americans inability to meet their mortgage payments set off a chain reaction leading to a worldwide credit crunch is an another such extraordinary circumstance. This one may require even more intervention by the Fed and other central banks around the world than we’ve witnessed already, in order to avoid a global financial meltdown. How much more? We’ll know more this coming week.

But what exactly happened to set this off? The story isn’t simple, but I’ll try to state it as simply as I can. In recent years, with so much money sloshing around the global economy, American banks and other mortgage lenders found themselves with lots of cash. They thought they could make a tidy profit by pushing home loans – not only on average Americans (whose eagerness to own a home or two thereby bid up housing prices) but also on poorer Americans who wanted to own a house but normally couldn’t afford the interest on the loans. Oddly, private credit-rating agencies judged these “sub-prime” loans to be relatively good risks. The loans were then sliced up and sold to other financial institutions where they were repackaged with other loans. Meanwhile, hedge funds created what can only be described as giant betting pools – huge amalgamations of money from pension funds, university endowments, rich individuals, and corporations – whose assumptions about risk were derived from the assumed low risks of the home loans (hence, the term, “derivatives”). Investors in these hedge funds had little or no understanding of what they were actually buying because hedge funds don’t have to disclose much of anything.

It was not just a housing bubble but a financial house of cards that would tumble when central bankers tightened up on the global money supply in order to fight inflation, as they inevitably would, and when the home loans were thereby revealed to be far riskier than thought. Because the bad loans are so widely dispersed and because so much additional credit is connected to them through derivatives, a contagion of fear has spread through financial markets. The credibility of the whole financial system has become shaky. Large numbers of stocks and bonds appear riskier than before, which is why Wall Street is taking a beating.

Americans are understandably nervous. Most American households have invested their savings in stocks and bonds. Most have also relied on the rising values of their homes as “nest-eggs” when they retire. The fact that the housing bubble has burst while stocks and bonds have lost ground is likely to cause American consumers to tighten their belts and cut their spending. Given that consumers comprise 70 percent of the economy, this could push America economy into a recession.

Europe and Asia are feeling the effects. The global financial market is now one big pool of money with spigots and drains all over the world. A loss of confidence on Wall Street is felt almost instantly in other financial capitals. Moreover, American consumers are the “energizer bunnies” of the global economy. Their purchases have maintained global demand even when other economies have sagged. The possibility that they won’t or can’t continue to buy is rocking all global corporations that sell them goods or services.

In other words, the Fed has to bail out the speculators because we’ll all suffer if it doesn’t.

That doesn’t mean, though, that the irresponsibilities now so clearly revealed in American financial markets should be excused or forgotten when the crisis ends. Wall Street has been living in an anything-goes world for too long. It has been widely – and wrongly – assumed that investors, creditors, and borrowers are smart enough to take care of themselves, especially if they’re big. That’s wrong.

The system has become so fast and so loose that many of the fancy financial instruments now in use, and the mathematical models on which they’re based, are too complicated for anyone except a computer to understand. Fortunes have been made exploiting tiny opportunities for arbitrage or devising new derivatives on the basis of data and risk assessments far less certain than they’re assumed to be.

Hedge funds have been operating huge financial casinos without having to disclose what they’re betting on, or why. Credit-rating agencies have cut corners or averted their eyes, unwilling to require the proof they need. They’ve been too eager to make money off underwriting of the new loans and other financial gimmicks on which they’re passing judgment. Banks and other mortgage lenders have been allowed to strong-arm people into taking on financial obligations they have no business taking on.

In order for the financial market to work well – to ensure fair dealing and to prevent speculative excess – government must oversee it. This mess occurred because no one was watching. The Fed and other central banks now have to clean it up. But regulators in American, Europe, and Asia have to make sure it stays clean. Hedge funds have to be more transparent. Credit-rating agencies must not have any relationship with underwriters. Banks and other mortgage lenders should be better supervised. Finance is too important to be left to the speculators.

>>

Thursday, August 16

Bush Legacy Article

<<

If one had to sum up the legacy of Karl Rove as political adviser to the 43rd president, it could probably be done in four words: tactical brilliance, strategic blindness.

Though George Bush was not given the natural gifts of a Ronald Reagan, his victories in Texas, followed by successive victories in the presidential contests in 2000 and 2004, put him in the history books alongside Reagan, who won California and the presidency twice.

None of Bush's wins were nearly so impressive as the Reagan landslides in the Golden State and the nation. But it is a testament to Rove that he and Bush never lost a statewide or national election in the four they contested from 1994 to 2004. Rove has two Super Bowl rings. How many political advisers can say as much?

But if Rove's contribution to the career of George Bush will put him in the Hall of Fame, the Bush-Rove legacy for their party is worse than mixed. Rove wanted to be the architect of a new Republican majority. Instead, he and Bush presided over the loss of the Reagan Democrats and both houses of Congress.

The house Nixon and Reagan built, Bush and Rove tore down, leaving rubble in its place. Rove's failure was a failure of vision. He and Bush believed the future of the party lay in adding to the Republican base the Latino vote, now the nation's largest minority at nearly 15 percent of the population.

They went about it the wrong way.

Pandering to that voting bloc, Bush stopped enforcing the immigration laws and offered amnesty to 12 million to 20 million illegal aliens and the businesses that hired them. Bush and Rove were going to lure the Latino vote away from the Democratic Party by putting illegals on a path to citizenship.

But as we saw in June, when the nation rose up in rage against the Bush amnesty, the pair did indeed unite the GOP - against themselves, and they severed themselves from the Reagan Democrats and the country.

It was cynical politics, and it backfired, crippling the presidential candidacy of Sen. John McCain in the process.

But even before the disastrous immigration reform bill, Bush had become a zealot of NAFTA, GATT and most-favored-nation status for China. These have left his country with the worst trade deficits in history, put the United States $2 trillion in debt to Beijing and Tokyo, cost Middle America 3 million manufacturing jobs and arrested the income rise of the middle class as our capitalist pigs and hedge-fund hogs have happily gorged themselves at the capital gains tax trough.

Bush's original idea of "compassionate conservatism" was a fine one. But under him and Rove, compassionate conservative turned out to be code for a cocktail of Great Society Liberalism and Big Government Conservatism. How could professed admirers of Ronald Reagan think that by doubling the budget of the Department of Education the tests scores of schoolchildren would inexorably rise?

Even earlier in the Bush years, the president, after the trauma of Sept. 11, had a Damascene conversion to neoconservatism, a neo-Wilsonian ideology and secular religion. Among its tenets: that we are a providential nation whose mission on Earth is to liberate mankind and democratize the planet; that we are in a world-historic struggle between good and evil; that our triumph is to be accomplished by the robust use of U.S. military power - beginning with the benighted nations of the Islamic Middle East that represent an existential threat to America, democracy and Israel.

Sometime between Sept. 11 and his axis-of-evil address, Bush sat down and ate of the forbidden fruit of messianic globaloney. Consuming it, he got up and committed the greatest strategic blunder in U.S. history by ordering the invasion of a country that had not attacked us, did not threaten us and did not want war with us.

The Bush-Rove rationale: For our survival, we had to disarm Iraq of weapons of mass destruction that we now know it did not have.

The great political architects of the 20th century are FDR and Nixon. After the three Republican landslides of the 1920s, FDR put together a New Deal coalition that controlled the White House for 36 years, with the exception of two terms for Eisenhower.

After the rout of the Republicans in 1964, Nixon pulled together a New Majority that held the White House for 20 of 24 years, racking up two 49-state landslides for Nixon and Reagan, as FDR had won 46 states in 1936. In his re-election bid, Bush won 31 states.

In seeking a new GOP majority, Bush and Rove rejected the Nixon-Reagan model. Instead, they embraced the interventionism of Wilson, the free-trade globalism of FDR, the open-borders immigration ideas of LBJ and the budget priorities of the Great Society. It was a bridge too far for the party base.

Now, Rove walks away like some subprime borrower abandoning the house on which he can no longer make the payments. The Republican Party needs a new architect. The firm of Bush & Rove was not up to the job."

>>

I couldn't have said it better myself.

Thursday, August 9

Taxes

Benjamin Franklin said that there are only two sure things in this world: death and taxes. I don't know if that's relevant, but any good diatribe involving taxes needs to include that quote.

Relatedly, another good quote comes from the blind irony of George W: "The death penalty, as we know, is unjustifiable." Of course, the President wasn't referring to the 152 individuals that were subjected to a "justifiable" penalty during his term as Governor of Texas...no, he was referring to the Estate Tax.

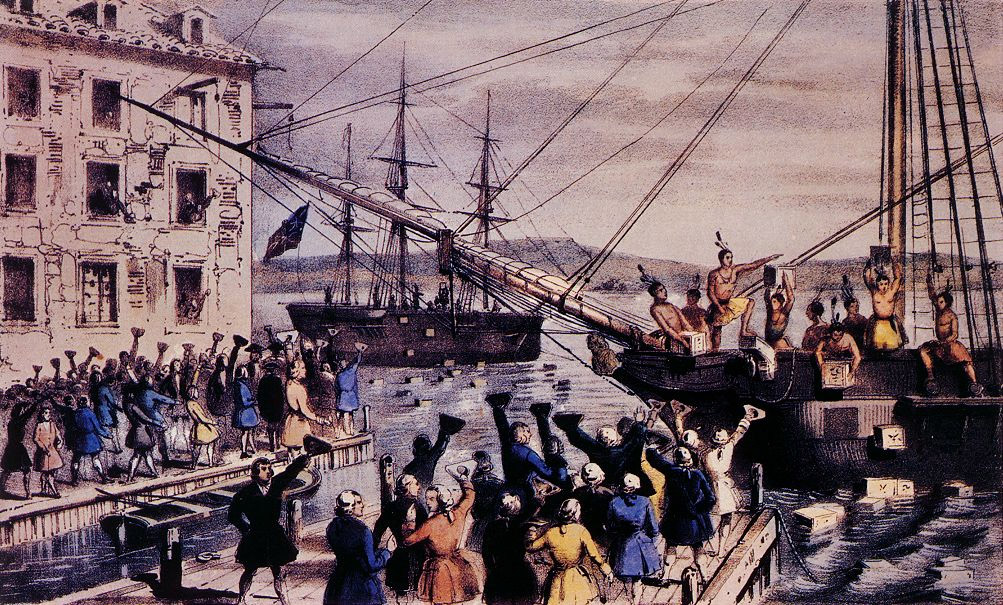

Americans are obsessed with taxes. We've been obsessed with taxes since the beginning. We declared independence to avoid British taxes and our Constitution was written as a response to a revolt against a tax (the "Whiskey Tax"). In the last 4 presidential elections the candidates of both parties have promised to cut taxes (the last one to not explicitly do so was Dukakis) and the next election will probably not be any different. Reagan changed American politics by riding a wave of "tax revolt,"

Mondale guaranteed Reagan a landslide victory in 1984 with this political blunder: "Mr. Reagan will raise your taxes and so will I. He won't tell you. I just did" (Reagan went on to raise taxes), in '88 George I won by advising people to read his lips and in '92 he lost after people found out his lips were lying, the most fiendish word in conservative talk-radio is a "tax-and-spend liberal" (as opposed to a "just-spend-conservative," apparently), and Democrats have totally given up a "war on poverty" as their rallying cry and have turned to "middle-class tax cuts" to find resonance with voters.

Mondale guaranteed Reagan a landslide victory in 1984 with this political blunder: "Mr. Reagan will raise your taxes and so will I. He won't tell you. I just did" (Reagan went on to raise taxes), in '88 George I won by advising people to read his lips and in '92 he lost after people found out his lips were lying, the most fiendish word in conservative talk-radio is a "tax-and-spend liberal" (as opposed to a "just-spend-conservative," apparently), and Democrats have totally given up a "war on poverty" as their rallying cry and have turned to "middle-class tax cuts" to find resonance with voters.With such an overwhelming obsession with taxes you would think that Americans must be the most overly taxed people on the planet. You might think that such an obsession is the resul

t of the crippling nature of the American tax code. Of course, you and I know better.

t of the crippling nature of the American tax code. Of course, you and I know better.As you may (or should) know, the U.S. has the lowest tax rates in the developed world, with the exception of Japan, which has a cap on military spending that stands at 1% of GDP. As a percentage of GDP, government in the U.S. extracts about 26% from its citizens. For Canada the number is about 38%, for France 45%, and for the crazy Swedes about 57%.

What's most amazing about these numbers is how low the American tax rate is considering our military spending. Currently, the U.S. government spends over $600 billion a year on military matters. This outrageous number is about 46% of the world's total military spending. In other words, the U.S. almost spends more on the military than the rest of the world...COMBINED! The second largest spender, China, spends 1/7 the amount that America does; Cuba, Iran, Sudan, Syria, North Korea, and Libya (the "rogue belligerent states") spend 1/29th as

much as we do...COMBINED!

much as we do...COMBINED!Given our high rate of military spending, you would think that our tax rates would be comparably high to pay for all that spending. Since the rest of the world is spending so much less on their military than us, their government spending should be much less. So, the next question is, what are all these countries spending money on that we aren't spending on?

One item is health care. Unlike the rest of the world, with the exception of our Medicare and Medicaid programs, our health care system is not publicly funded. It's not that we don't spend money on health care (as I mentioned in a previous diatribe, we spend almost twice as much as any other country) it's that our dollars go to private corporations rather than the government.

Another one is the variety of social programs common in the rest of the world. These include maternity/paternity leave, a variety of daycare services for families with children, and much more generous old-age insurance and unemployment insurance.

The final big item is redistributive programs. These include welfare in all its varieties, tax breaks for the poor, food programs, health care for the unemployed/ impoverished, etc. Currently the U.S. spends about 21% of the federal budget on such programs, while the rest of the world spends about twice that much.

The final big item is redistributive programs. These include welfare in all its varieties, tax breaks for the poor, food programs, health care for the unemployed/ impoverished, etc. Currently the U.S. spends about 21% of the federal budget on such programs, while the rest of the world spends about twice that much.Contrary to popular belief, our spending on education and infrastructure is comparable (above average on education, below average on infrastructure) to the rest of the world.

When Americans complain about high taxes they are usually complaining about one particular tax: the income tax. Unless you're super rich, the Estate Tax will never become an issue and most people don't complain about their social security payroll taxes. So, where do our income taxes go? The easy answer is the federal government. More than 90% of income taxes go to the federal government, and 9 states have no income tax. The more complicated answer is the following:

For every dollar:

-42 cents goes to military spending, veteran's care, and military generated debt interest.

-17 cents goes to fund Medicaid.

-10 cents goes to paying interest on non-military generated debt.

-19 cents goes to running the government (including homeland security in all its forms)

-9 cents goes to education, etc.

-2 cents goes to public lands administration

-8 cents goes to welfare programs like AFDC, food stamps, job training, disability assistance, public housing, etc.

-1 cent to diplomatic services/international aid

The other tax that has generated interest recently for obvious reasons is the gas tax. The American gasoline tax is the lowest in the developed world (18.2 cents) and is all spent on road maintenance (and not at all on researching alternative energies).

Unlike most of the rest of the developed world, the U.S. does not have a national sales tax/ Value Added Tax (VAT), but state and local governments often impose one. In my state, California, there is a 7.25 % sales tax. Local authorities have added an additional 1% to that tax to pay for a variety of services. In most of the rest of the developed world, a VAT is administered nationally, is imposed upon consumers AND retailers, does not apply to base items like food and clothing, and can be as high as 20 or even 30%.

I won't even spend time talking about the estate tax, which only applies to 2500 families in the country.

To conclude, the American people are probably the most undertaxed people in the developed world. We are so undertaxed that we don't even pay for the smallest government in the developed world as a percentage of GDP. I can understand if Sweden had a huge deficit (which they don't), but how is it that we have a national

debt of nearly $9 Trillion!!! Here's some fun numbers: to pay for the debt each citizen would have to pay, on average, $29,500 (in other words we, by we I mean every man, woman, child, baby, on average have been running our government credit card bills to the size of nearly $30,000...a family of four, then, on average owes the government $120,000), the debt is growing $1.39 billion...a day!, if you set aside $7 million dollars every day since the birth of Christ you would have enough money to pay off the debt some time in March of 2458, etc. But there's good news! This year's deficit will probably be around $148.5 billion, down from the high point of $412 billion in 2004 [cheers all around]. So, what does that mean? It means that our debt is only GROWING by about $150 billion this year...I think we all have reason to be proud. Miracuously, during the late 90s, Bill Clinton was able to generate a surplus of $400 billion, meaning that we were actually able to reduce our debt! Of course, we didn't...that money mostly went to tax cuts. Hopefully, some day we'll actually have a surplus and be able to begin to pay off the debt, but one can only dream.

debt of nearly $9 Trillion!!! Here's some fun numbers: to pay for the debt each citizen would have to pay, on average, $29,500 (in other words we, by we I mean every man, woman, child, baby, on average have been running our government credit card bills to the size of nearly $30,000...a family of four, then, on average owes the government $120,000), the debt is growing $1.39 billion...a day!, if you set aside $7 million dollars every day since the birth of Christ you would have enough money to pay off the debt some time in March of 2458, etc. But there's good news! This year's deficit will probably be around $148.5 billion, down from the high point of $412 billion in 2004 [cheers all around]. So, what does that mean? It means that our debt is only GROWING by about $150 billion this year...I think we all have reason to be proud. Miracuously, during the late 90s, Bill Clinton was able to generate a surplus of $400 billion, meaning that we were actually able to reduce our debt! Of course, we didn't...that money mostly went to tax cuts. Hopefully, some day we'll actually have a surplus and be able to begin to pay off the debt, but one can only dream.'How did we get this HUGE debt?', hopefully you're asking. As recently as the early 1960s we had almost no debt whatsoever. What happened? Well, Vietnam happened. OPEC happened. Reagan and defense expenditure growth happened. Also the "enormous" increase in welfare spending happened, according to conservatives, reaching as high as 1/4 of our defense spending at one point. But even more importantly, tax cuts happened.

Kennedy inaugurated the era of the tax cuts. Kennedy began a trend that has continued to this day. In 1962 his tax bill called for massive tax cuts. For the median income earner, the tax rate dropped from about 32% to 28%. Since that time, taxes have continually been slashed for middle income families until they've reached the present bottom of...26%. ...Wait...the drop from 1962 to 2007, after Reagan and Bush and Bush has only been 2%? So where has the drop of taxes gone? Well, for one, more impoverished people have become excempt from paying taxes and their tax rates have gone down. But, this is a miniscule drop. The real drop can be found somewhere else:

Kennedy inaugurated the era of the tax cuts. Kennedy began a trend that has continued to this day. In 1962 his tax bill called for massive tax cuts. For the median income earner, the tax rate dropped from about 32% to 28%. Since that time, taxes have continually been slashed for middle income families until they've reached the present bottom of...26%. ...Wait...the drop from 1962 to 2007, after Reagan and Bush and Bush has only been 2%? So where has the drop of taxes gone? Well, for one, more impoverished people have become excempt from paying taxes and their tax rates have gone down. But, this is a miniscule drop. The real drop can be found somewhere else:Let's look at the tax rate for the highest bracket incomes (currently these apply to individuals who make more than $336,500 a year). Under the obviously socialistic Eisenhower, the highest tax rate was 91%! Kennedy sl

By the way, Kerry was attacked in 2004 for trying to raise taxes. He was proposing raising the highest bracket tax rate. His proposal would raise it to 38%...communist.

Monday, August 6

Read This!

An amazing follow up to my own article about health care by my hero Paul Krugman (I mean,... Machiavelli Krugman). Link