Benjamin Franklin said that there are only two sure things in this world: death and taxes. I don't know if that's relevant, but any good diatribe involving taxes needs to include that quote.

Relatedly, another good quote comes from the blind irony of George W: "The death penalty, as we know, is unjustifiable." Of course, the President wasn't referring to the 152 individuals that were subjected to a "justifiable" penalty during his term as Governor of Texas...no, he was referring to the Estate Tax.

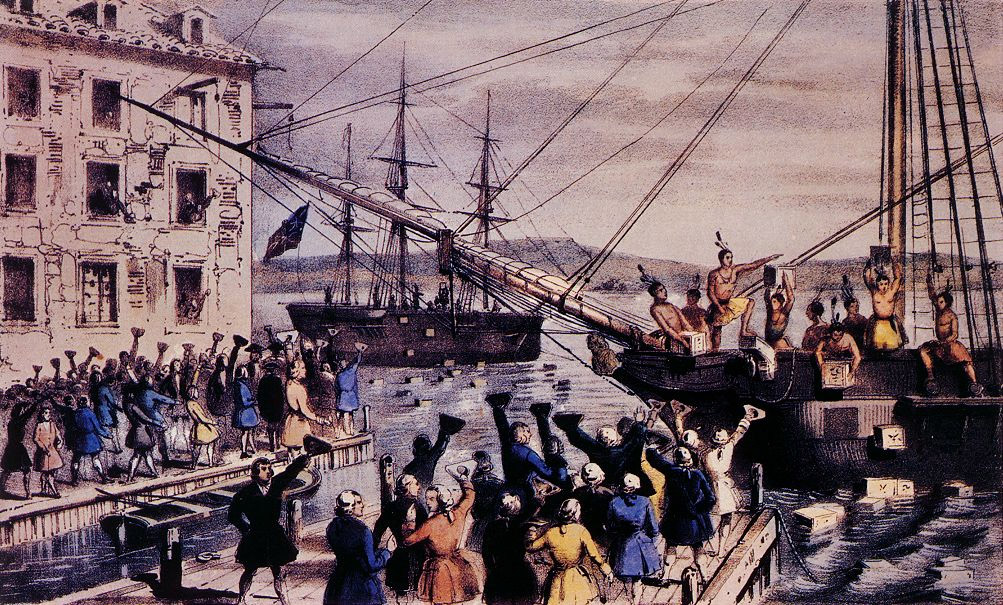

Americans are obsessed with taxes. We've been obsessed with taxes since the beginning. We declared independence to avoid British taxes and our Constitution was written as a response to a revolt against a tax (the "Whiskey Tax"). In the last 4 presidential elections the candidates of both parties have promised to cut taxes (the last one to not explicitly do so was Dukakis) and the next election will probably not be any different. Reagan changed American politics by riding a wave of "tax revolt,"

Mondale guaranteed Reagan a landslide victory in 1984 with this political blunder: "Mr. Reagan will raise your taxes and so will I. He won't tell you. I just did" (Reagan went on to raise taxes), in '88 George I won by advising people to read his lips and in '92 he lost after people found out his lips were lying, the most fiendish word in conservative talk-radio is a "tax-and-spend liberal" (as opposed to a "just-spend-conservative," apparently), and Democrats have totally given up a "war on poverty" as their rallying cry and have turned to "middle-class tax cuts" to find resonance with voters.

Mondale guaranteed Reagan a landslide victory in 1984 with this political blunder: "Mr. Reagan will raise your taxes and so will I. He won't tell you. I just did" (Reagan went on to raise taxes), in '88 George I won by advising people to read his lips and in '92 he lost after people found out his lips were lying, the most fiendish word in conservative talk-radio is a "tax-and-spend liberal" (as opposed to a "just-spend-conservative," apparently), and Democrats have totally given up a "war on poverty" as their rallying cry and have turned to "middle-class tax cuts" to find resonance with voters.With such an overwhelming obsession with taxes you would think that Americans must be the most overly taxed people on the planet. You might think that such an obsession is the resul

t of the crippling nature of the American tax code. Of course, you and I know better.

t of the crippling nature of the American tax code. Of course, you and I know better.As you may (or should) know, the U.S. has the lowest tax rates in the developed world, with the exception of Japan, which has a cap on military spending that stands at 1% of GDP. As a percentage of GDP, government in the U.S. extracts about 26% from its citizens. For Canada the number is about 38%, for France 45%, and for the crazy Swedes about 57%.

What's most amazing about these numbers is how low the American tax rate is considering our military spending. Currently, the U.S. government spends over $600 billion a year on military matters. This outrageous number is about 46% of the world's total military spending. In other words, the U.S. almost spends more on the military than the rest of the world...COMBINED! The second largest spender, China, spends 1/7 the amount that America does; Cuba, Iran, Sudan, Syria, North Korea, and Libya (the "rogue belligerent states") spend 1/29th as

much as we do...COMBINED!

much as we do...COMBINED!Given our high rate of military spending, you would think that our tax rates would be comparably high to pay for all that spending. Since the rest of the world is spending so much less on their military than us, their government spending should be much less. So, the next question is, what are all these countries spending money on that we aren't spending on?

One item is health care. Unlike the rest of the world, with the exception of our Medicare and Medicaid programs, our health care system is not publicly funded. It's not that we don't spend money on health care (as I mentioned in a previous diatribe, we spend almost twice as much as any other country) it's that our dollars go to private corporations rather than the government.

Another one is the variety of social programs common in the rest of the world. These include maternity/paternity leave, a variety of daycare services for families with children, and much more generous old-age insurance and unemployment insurance.

The final big item is redistributive programs. These include welfare in all its varieties, tax breaks for the poor, food programs, health care for the unemployed/ impoverished, etc. Currently the U.S. spends about 21% of the federal budget on such programs, while the rest of the world spends about twice that much.

The final big item is redistributive programs. These include welfare in all its varieties, tax breaks for the poor, food programs, health care for the unemployed/ impoverished, etc. Currently the U.S. spends about 21% of the federal budget on such programs, while the rest of the world spends about twice that much.Contrary to popular belief, our spending on education and infrastructure is comparable (above average on education, below average on infrastructure) to the rest of the world.

When Americans complain about high taxes they are usually complaining about one particular tax: the income tax. Unless you're super rich, the Estate Tax will never become an issue and most people don't complain about their social security payroll taxes. So, where do our income taxes go? The easy answer is the federal government. More than 90% of income taxes go to the federal government, and 9 states have no income tax. The more complicated answer is the following:

For every dollar:

-42 cents goes to military spending, veteran's care, and military generated debt interest.

-17 cents goes to fund Medicaid.

-10 cents goes to paying interest on non-military generated debt.

-19 cents goes to running the government (including homeland security in all its forms)

-9 cents goes to education, etc.

-2 cents goes to public lands administration

-8 cents goes to welfare programs like AFDC, food stamps, job training, disability assistance, public housing, etc.

-1 cent to diplomatic services/international aid

The other tax that has generated interest recently for obvious reasons is the gas tax. The American gasoline tax is the lowest in the developed world (18.2 cents) and is all spent on road maintenance (and not at all on researching alternative energies).

Unlike most of the rest of the developed world, the U.S. does not have a national sales tax/ Value Added Tax (VAT), but state and local governments often impose one. In my state, California, there is a 7.25 % sales tax. Local authorities have added an additional 1% to that tax to pay for a variety of services. In most of the rest of the developed world, a VAT is administered nationally, is imposed upon consumers AND retailers, does not apply to base items like food and clothing, and can be as high as 20 or even 30%.

I won't even spend time talking about the estate tax, which only applies to 2500 families in the country.

To conclude, the American people are probably the most undertaxed people in the developed world. We are so undertaxed that we don't even pay for the smallest government in the developed world as a percentage of GDP. I can understand if Sweden had a huge deficit (which they don't), but how is it that we have a national

debt of nearly $9 Trillion!!! Here's some fun numbers: to pay for the debt each citizen would have to pay, on average, $29,500 (in other words we, by we I mean every man, woman, child, baby, on average have been running our government credit card bills to the size of nearly $30,000...a family of four, then, on average owes the government $120,000), the debt is growing $1.39 billion...a day!, if you set aside $7 million dollars every day since the birth of Christ you would have enough money to pay off the debt some time in March of 2458, etc. But there's good news! This year's deficit will probably be around $148.5 billion, down from the high point of $412 billion in 2004 [cheers all around]. So, what does that mean? It means that our debt is only GROWING by about $150 billion this year...I think we all have reason to be proud. Miracuously, during the late 90s, Bill Clinton was able to generate a surplus of $400 billion, meaning that we were actually able to reduce our debt! Of course, we didn't...that money mostly went to tax cuts. Hopefully, some day we'll actually have a surplus and be able to begin to pay off the debt, but one can only dream.

debt of nearly $9 Trillion!!! Here's some fun numbers: to pay for the debt each citizen would have to pay, on average, $29,500 (in other words we, by we I mean every man, woman, child, baby, on average have been running our government credit card bills to the size of nearly $30,000...a family of four, then, on average owes the government $120,000), the debt is growing $1.39 billion...a day!, if you set aside $7 million dollars every day since the birth of Christ you would have enough money to pay off the debt some time in March of 2458, etc. But there's good news! This year's deficit will probably be around $148.5 billion, down from the high point of $412 billion in 2004 [cheers all around]. So, what does that mean? It means that our debt is only GROWING by about $150 billion this year...I think we all have reason to be proud. Miracuously, during the late 90s, Bill Clinton was able to generate a surplus of $400 billion, meaning that we were actually able to reduce our debt! Of course, we didn't...that money mostly went to tax cuts. Hopefully, some day we'll actually have a surplus and be able to begin to pay off the debt, but one can only dream.'How did we get this HUGE debt?', hopefully you're asking. As recently as the early 1960s we had almost no debt whatsoever. What happened? Well, Vietnam happened. OPEC happened. Reagan and defense expenditure growth happened. Also the "enormous" increase in welfare spending happened, according to conservatives, reaching as high as 1/4 of our defense spending at one point. But even more importantly, tax cuts happened.

Kennedy inaugurated the era of the tax cuts. Kennedy began a trend that has continued to this day. In 1962 his tax bill called for massive tax cuts. For the median income earner, the tax rate dropped from about 32% to 28%. Since that time, taxes have continually been slashed for middle income families until they've reached the present bottom of...26%. ...Wait...the drop from 1962 to 2007, after Reagan and Bush and Bush has only been 2%? So where has the drop of taxes gone? Well, for one, more impoverished people have become excempt from paying taxes and their tax rates have gone down. But, this is a miniscule drop. The real drop can be found somewhere else:

Kennedy inaugurated the era of the tax cuts. Kennedy began a trend that has continued to this day. In 1962 his tax bill called for massive tax cuts. For the median income earner, the tax rate dropped from about 32% to 28%. Since that time, taxes have continually been slashed for middle income families until they've reached the present bottom of...26%. ...Wait...the drop from 1962 to 2007, after Reagan and Bush and Bush has only been 2%? So where has the drop of taxes gone? Well, for one, more impoverished people have become excempt from paying taxes and their tax rates have gone down. But, this is a miniscule drop. The real drop can be found somewhere else:Let's look at the tax rate for the highest bracket incomes (currently these apply to individuals who make more than $336,500 a year). Under the obviously socialistic Eisenhower, the highest tax rate was 91%! Kennedy sl

By the way, Kerry was attacked in 2004 for trying to raise taxes. He was proposing raising the highest bracket tax rate. His proposal would raise it to 38%...communist.

2 comments:

Both parties despite rhetoric, are responsible for the assault on working class people, paying disproportionate taxes.

Conservatives are philosophically for starving government, except for roads and military. They never rule long, because government is needed even to implement an anti-government program. They want programs to fail.

Liberals use taxes for social programs as patronage.

Ultimately a tax cut means service cut.

Patronage? Welfare is distributed to such a small percentage of the population that it is electorally insignificant. Additionally, reception of welfare has almost no bearing on which party you vote for. Much more important factors are race and geography.

Other social programs, including social security, are distributed to the entire nation. This includes both "liberals" and "conservatives."

Despite your cute cynicism and an historical legacy, there is only one party currently responsible for the ridiculous maldistribution of wealth and taxes.

Post a Comment